Landmark legislation that would expand education choice eligibility to all Florida’s K-12 students and add spending flexibility to all state choice scholarship programs headed toward its final journey on Wednesday before being signed into law.

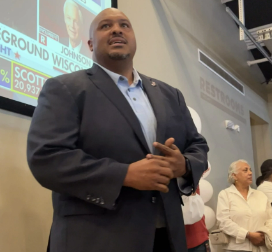

Sen. Corey Simon, R-Tallahassee, the sponsor of SB 202, introduced the bill but then agreed to substitute a committee version of HB 1, the House version that won final approve in that chamber last week.

Like its Senate companion, the House bill, sponsored by Rep. Kaylee Tuck, R-Lake Placid, would make all the state’s students eligible for the Family Empowerment Scholarship.

“This is about increasing options for families to choose the best for their students and options for school districts,” Simon said in introducing the bill.

Unlike in the original law approved in 2019, the program as outlined in HB 1 would be open to all students regardless of income. However, families whose incomes fall below 185% of the federal poverty line would receive first priority, followed by those with incomes up to 400% above the federal poverty line. Those with incomes above the 400% threshold would be last in line to receive any remaining funding.

Another provision in HB 1 requires that funding for the formerly income-based scholarships would first have to come from private tax credit donations that were previously used to fund the Florida Tax Credit Scholarship program before receiving money from state education funds.

In addition to expanding eligibility, HB 1 would convert traditional scholarship programs into education savings accounts. Such accounts take funds that would have been directed to an institution and allow parents to use them to customize their child’s education.

Under the bill, the funds, expected to be around $8,000 per student depending on where the family lives, can be spent on approved instructional costs, tutoring and fees for various exams in addition to private school tuition.

In addition, HB 1 also extends eligibility to homeschooled students, who would be classified separately from those whose families choose not to participate. Participating families would be under a “personalized education program” and would have to submit to an annual “sworn compliance statement” that would include various requirements such as taking a nationally norm-referenced exam or statewide assessment and report the results to the school choice funding organization.

(Step Up For Students, which manages the majority of state education choice scholarship programs, hosts this blog.)

Besides expanding options for students, the bill also would relax some district school regulations identified by the Florida Association of District School Superintendents.

For example, the bill reduces hurdles to a five-year temporary teacher certification for anyone with a bachelor’s degree and for those with two years of effective or highly effective service. The bill provides flexibility to school districts in setting salary schedules. The bill repeals the requirement that public school students have one online credit to graduate from high school, which is not currently required in private schools. The bill also offers districts flexibility in facility costs for new construction, and allows school districts to transport students in large vans as opposed to school buses if needed.

During the full Senate proceedings, opponents questioning the logistics of the bill and the cost, which Senate and House analysists had calculated differently. They also asked whether money for the scholarships would be taken out of the state’s education funding formula for public schools.

The answer, Sen. Keith Perry, R-Gainesville, said is no, although “you’ll see a big increase in that fund as well.”

Perry, who chairs the Senate Appropriations Committee on Education, said the state has separately allocated $2.2 billion for the scholarship program, with an extra $350 million in a reserve fund. Also, money from the Florida Tax Credit program will be used to pay for scholarships.

HB 1 is set for vote in the full Senate, which begins its session at 1:30 p.m. today.

This new legislation will expand the FTC and FESEO voucher programs throughout the state of Florida but what does that actually mean for Florida families; and will all Florida families really be able to choose to use the voucher program? Let’s break it down.

There are three primary types of voucher programs in the state of Florida: the FTC voucher,and the two family empowerment vouchers (FESUA and FESEO.)

The Florida Tax Credit (FTC) program, was established in 2001 to “expand educational opportunities for low-income families.” This voucher is administered by Step Up for Students and is paid for through individuals/corporations receiving a tax credit for donations made. The problem with this voucher is that it is only worth approximately 8k and because the average tuition at private schools in Florida is about 12 K it means that the cost of the voucher rarely covers the cost of tuition; making the voucher itself inaccessible to working class and low income families. In fact, at the end of the 2021-2022 school year, (when this voucher was only there available to low income families) there was $255 million of unused FTC funds. Going forward we will likely continue to see the same numbers for the working-class population ( where families opt to stay in public schools because even with this voucher, the private schools remain unaffordable to them) while, on the other hand, we will also see an increase in wealthy families getting the scholarship, because the legislation changed the restrictions on income and made the voucher “universal.”

The other type of voucher ( which is part of the Family Empowerment scholarship) that was made “ universally accessible” “ regardless of income” is the Educational Opportunity (FES-EO) voucher. As with the FTC voucher, the FES-EO voucher used to only available to low-income families. For the same reasons as the FTC program, the demand for the FES-EO program was low because its old target demographic (even with the voucher) could not afford tuition at quality accredited private schools; (in 2021-2021 there were nearly 22,000 vouchers left unclaimed.) It is again very likely that for the same reasons as the FTC scholarship we will not see much of a change to the population of working-class and low-income families attending private schools, but we will see an increase in wealthy families, already attending private schools receiving the scholarship, regardless of whether they need it or not.

The final type of voucher (and one that is NOT going to be expanded under this new legislation) is the part of the Family Empowerment Scholarship that focuses on special needs students. The FES-Unique Abilities(UA) voucher essentially merged the Gardiner and McKay Scholarship and now gives vouchers worth nearly 10k per student to children with disabilities. The problem with the FES-UA voucher is that it is limited in funding. In 2021-2022, only 25,000 students received a voucher leaving nearly 10,000 on the waitlist and while the new legislation does increase the growth of these vouchers to 3% (or 5,000 students) that is a meager number (for such a high-demand voucher) when compared to the population of nearly 425,000 disabled students in Florida.

Other than it being a limited resource the other problem with the FES-UA voucher is that because private schools are not required to follow the law that protects disabled children and their right to accommodations, (Individuals with Disabilities Education Act) families are left with only two choices: 1. Stay in public school (where they are legally obligated to accommodate disabled children) or 2. Find a private specialty school willing to follow IDEA law; the problem with specialty schools is that most of them cost upwards of $20,000 a year, making them unaffordable (even with a 10k voucher) to most special needs families

When we see it all laid out like this, it begs the question, “Who will actually get to choose school choice?” If HB1/SB 202 made no changes to the voucher cap on the high-demand FES-UA vouchers (for students with disabilities ) but removed the voucher cap and the income requirements for low-demand FTC and FES-EO vouchers then who is benefiting from this policy change? Because It’s not the special needs children, (85% of whom will remain in public schools to receive the proper accommodations,) and it’s not the low-income and middle-class families; (for whom quality accredited private schools remain too expensive.)

This leaves us with an unsettling answer: School Choice was not and never will be about giving choice to all Florida families; rather, it is about giving a tax write off reward to those privileged enough to have already made the choice to opt out of public education.