Editor's note: The Rev. Manuel Sykes is pastor of Bethel Community Baptist Church and president of the St. Petersburg NAACP, an active chapter on Florida's west coast. In this commentary, he responds to a recent Tampa Bay Times column that criticized a federal tax credit scholarship bill offered by U.S. Sen. Marco Rubio. The Times also published a letter to the editor from Rev. Sykes in today's editions.

Florida offers the nation’s best lesson on whether private school options can help poor children, but the Tampa Bay Times seems uninterested in what these parents and students are telling us. Instead, it is busy pointing a distinctly partisan finger.

Florida offers the nation’s best lesson on whether private school options can help poor children, but the Tampa Bay Times seems uninterested in what these parents and students are telling us. Instead, it is busy pointing a distinctly partisan finger.

Argue if you want about whether the federal government should provide K-12 scholarships to low-income students, but the tax credit scholarship plan introduced by Republican U.S. Sen. Marco Rubio is not “bankrupt” or “craven.” It is instead a learning option that economically disadvantaged students wouldn’t otherwise have, and to label it as “money laundering” represents the kind of rhetorical excess that cheapens our public debate.

In Florida, more than 50,000 students are on a similar plan, and the results are encouraging to those of us who work with struggling children. The students who use the Florida Tax Credit Scholarship are truly poor – incomes barely above poverty and averaging less than $25,000 for a household of four – and more than two thirds of them are black or Hispanic. State research tells us they were among the lowest academic performers in the public schools they left behind, and testing results show they are making the same academic gains as students of all income levels nationally. Just as encouraging, the traditional public schools that are most impacted by students who choose the scholarships are themselves experiencing higher learning gains.

The educational results don’t seem to matter to those who prefer instead to dismiss scholarships as some kind of Republican conspiracy. Never mind that nearly half the Democrats in Florida’s Legislature also support this option, including a majority of the Black Caucus. Never mind those of us who work in disadvantaged communities in St. Petersburg and see children for whom these opportunities can make the difference between a diploma or a jail cell. Never mind that the Black Alliance for Educational Options, which represents elected black Democrats across the nation, has expressed its support for Rubio’s bill. (more…)

Eleven states currently offer tax credits to specified taxpayers who make contributions to tax-exempt non-profit organizations that in turn use those contributions to fund scholarships for qualifying, financially-needy, elementary and/or secondary school students attending private schools. This fairly recent development is currently empowering perhaps 150,000 lower-income families, who generally are unable to afford private schools, to make this sort of school choice for their children. To be clear, these plans provide benefits for taxpayers who make contributions that help other people’s children attend private schools.

Sen. Marco Rubio, R-Fla., has just introduced a bill that would expand this tax credit scholarship initiative nationwide. To understand the good (and dubious) features of Senator Rubio’s proposal, it is important to appreciate the state law background against which it is set.

Florida has the financially largest of these 11 state tax credit programs, with about 50,000 children currently participating. It restricts the scholarships to children from truly low-income households; the child must be eligible for a free- or reduced-price school lunch – currently just over $40,000 a year for a family of four. Other states are more generous, with Oklahoma reaching well into the middle class since there a family of four can still qualify with $120,000 in annual income. Senator Rubio’s plan, while not as tightly restricted as Florida’s, focuses the scholarships on families with income no more than 250 percent of the poverty level, which is a bit over $50,000 today. The main thing to emphasize here is the senator clearly seeks by his bill to empower the least well-off Americans who are currently least able to exercise school choice – a choice that more well-to-do families make by either moving to a better public school district or paying for private schools on their own.

Several state plans give tax credits to both individual and corporate donors (and for corporate donors the plans sometimes allow credits against a variety of state taxes). Senator Rubio’s bill does the same – allowing married couples and single taxpayers both to obtain a federal income tax credit for an annual contribution of up to $4,500, and allowing corporations an annual corporate income tax credit of up to $100,000. Florida by contrast only allows corporate tax credits and Arizona (which was the first state to adopt this program) initially granted only individual tax credits. Senator Rubio’s proposed tax credit limit for couples and individuals is about twice that now allowed in Arizona. Some states have no cap on donations, and indeed in Florida a few very large corporate donors contribute millions each year to the plan.

Senator Rubio’s proposed tax credit is a 100 percent credit, as is true in both Florida and Arizona, for example. This means that for every qualifying dollar contributed, federal income taxes would be reduced by a dollar. This essentially makes contributions costless to the donors. They, in effect, are able to re-direct their tax dollars to this specific cause – helping needy families send their children to private schools. It is worth nothing, however, that some states grant only a partial tax credit, such as the 65 percent credit allowed in Iowa and the 50 percent credit allowed in Indiana. In those latter states, donors must put up some of their own money.

Most states that adopted these plans imposed a maximum overall limit on the amount of tax credits that may be claimed each year in support of the program. These maxima vary enormously and even so are often not reached. Senator Rubio’s plan has no such limit. It probably would be complicated and costly, but clearly not impossible, for the IRS to administer an overall ceiling in a way that allowed would-be donors to know whether their contribution was within the national maximum and hence truly eligible for the credit.

One important difference between many state plans and Senator Rubio’s proposal is there is no limit on the amount of the scholarship that may be awarded. Florida, for example, caps scholarships at $4,335 at present; in Georgia the limit is just over $9,000. Hence, as appears to be the case in states like Iowa and Indiana, it would be legally possible under the senator’s plan for a child to win a full scholarship to a very high cost, elite private school and hence indirectly obtain government financial aid well beyond what is now being spent on public schools. This is perhaps unwise. Note, however, that nothing in Senator Rubio’s bill would require scholarship granting organizations to award full scholarships or high-value scholarships. In many states at present, the average scholarship is less than $2,000 a year. Since it would be rare to find a school with tuition that low, either the families must find some way to come up with the difference, or the schools must use their own financial aid plans to make up some or all of the gap.

The most striking difference between most state plans and Senator Rubio’s is children already enrolled in private schools would be eligible for scholarships. (more…)

I am grateful to Rebecca Sibilia and Sean Gill for their thoughtful response to my blog post encouraging Michelle Rhee to replace her failing schools model of school choice with an approach based on equal opportunity.

Rebecca and Sean defended StudentsFirst’s support of the failing schools model on pragmatic grounds. They wrote: “When state resources are limited or the existing supply of desirable private schools is limited, it also makes sense to prioritize vouchers or scholarships for those low-income children attending a low-performing school or living in low-performing school districts.”

Every community suffers from an insufficient supply of effective schools for low-income students. But in Florida we’ve learned that increasing demand - not limiting demand - is the best way to increase supply.

Access to Florida’s tax credit scholarship program for low-income students, which I help administer, is limited by a state-imposed cap. But our demand is not limited, so it often exceeds supply. This excess demand has not had a negative effect on students or the program. Instead, it has generated political pressure on the state Legislature to allow our cap to rise to meet this additional demand.

In 2010, as a result of excessive demand, the Florida Legislature voted to allow our program to grow 25 percent every year the demand hits or exceeds 90 percent of supply. The result has been extraordinary growth of supply and demand. While we have been awarding scholarships since 2002, 34 percent of our growth has occurred in just the last two years. This school year we added 10,000 more students to the program and had more than 12,000 students add their names to our waiting list after we hit our cap.

We’ve also been adding about 100 new private schools per year to the program, and some have started to expand their physical capacity to serve more students. Had we adopted the StudentsFirst approach of limiting demand when faced with limited supply, this extraordinary growth would not have occurred.

Today, more than 43 percent of Florida’s preK-12 students attend a school other than their assigned district school. Charter schools, magnet schools, virtual schools, career academies, dual enrollment and homeschooling are all growing dramatically. Private schools are already struggling to maintain their market share given all these choices. If we were to limit our scholarships to low-income students in state-designated failing schools, then many private schools serving low-income students might be forced to close - to everyone’s detriment. (more…)

On Wednesday, U.S. Sen. Marco Rubio, R-Fla., introduced a bill that would create a federal tax credit scholarship program for low-income students. Today he offers his thoughts about it in an op-ed for the Tampa Bay Times. Here's an excerpt:

Unfortunately, hundreds of thousands of schoolchildren in our country are not as fortunate as I was. These children are being failed by our nation's broken public school system, and they and their parents deserve the freedom and flexibility of school choice. There is perhaps no greater symbol of failure in our education system and our society than the worried faces of parents sending their kids off to a failing school because they don't have the liberty to choose a better, safer school.

While some students may be lucky enough to attend high-quality public charter schools in their areas, a private school education has become unattainable for the majority of low-income and middle-class families. It's too difficult for parents in today's economic environment to incur the financial burden of paying tuition at a private school, forcing parents to bypass better and safer education options.

Further, because of our nation's fiscal crisis, private schools may not be able to distribute a high number of institutionally funded scholarships to children. The result is a large number of students and families yearning for the opportunity of gaining a better education at a high-performing private school that will adequately prepare them to compete in a 21st century global economy.

To ensure that more American children receive that opportunity, I have introduced the Educational Opportunities Act, to create a new federal tax credit for individuals and corporations to help families pay for expanded educational opportunities. Full op-ed here.

This is the fourth in a series of brief observations on the ideal technical design of state systems using “vouchers” as the means to empower parents to choose their child’s school. Vouchers are to be distinguished from tax credits; the latter fund parents indirectly through private contributions to charitable organizations, thus reducing the donor’s tax liability; the whole or part of the contribution can be credited against the contributor’s taxes. The charity then awards scholarships either to schools or to families whom it selects from among its applications.

This is the fourth in a series of brief observations on the ideal technical design of state systems using “vouchers” as the means to empower parents to choose their child’s school. Vouchers are to be distinguished from tax credits; the latter fund parents indirectly through private contributions to charitable organizations, thus reducing the donor’s tax liability; the whole or part of the contribution can be credited against the contributor’s taxes. The charity then awards scholarships either to schools or to families whom it selects from among its applications.

By contrast, the voucher is simply an award of government money directly to the parents to be used for the child’s tuition at their chosen school. Vouchers will be our subject.

Why are rules important here? Why not just let the two parties - parent and school - bargain? If either says no, Suzie goes elsewhere. Such a system is imaginable, but in this society, improbable and possibly unjust. Rules of admissions are perhaps the most controversial element in the design of systems of choice - certainly of vouchers. Consider the following cases:

Susie’s mother wants her in Mozart High which emphasizes music as the medium of learning. Susie is tone deaf and hates music. Should she, by law, displace Jim, the gifted student next behind her in the lottery run by the school? And why must the school be using a lottery in the first place? And why shouldn’t the more gifted child simply have precedence?

Or, try this one. Arthur, who is black, also drew the short stick in the lottery. The school - otherwise all white - wants to admit him. Of course, to do so, someone else must get bumped.

Or, again, a disabled child wants entry to St. Cecilia, a small Catholic school with no facilities to accommodate her and no resources to redesign the school. What’s the point of forcing her admission?

Schools differ greatly in virtually every respect except in their (presumed) capacity to teach “the basics” as these are defined by law in the particular state. Furthermore, with respect to the basics, schools are free to employ a very wide range of methods. Often it is important that the pupil population come prepared to do it the school’s distinctive way. Still it is also crucial that kids who are less attractive to the school have the benefit of their parents’ choice.

Of course, long before the problem of admission even arises, a school may advertise, both positively and negatively, in order to maximize those applications it desires. It may also try directly to dissuade the unwelcome parent. In addition (as noted earlier in Essay #2) the school may, with fair warning and due process, expel a student who, after a fair trial, simply doesn’t make it. Still, the process of choice by the school itself can be confounded, for example, by an unexpected bubble of applications from children who “just don’t fit.” St. Cecilia, a Catholic school, may wish the best for Muslim applicants, but their sheer number may present a serious pedagogical problem. Like our current leaders on the Potomac, schools and parents need both a spirit of - and a mechanism for - compromise. (more…)

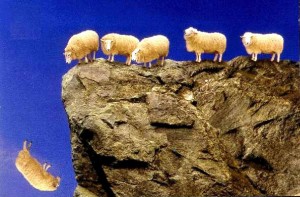

Many of our more public minds oppose aid to families who want, but can’t afford, a non-government school. For working families and the poor, the guru’s motto appears to be “public school only.” He endorses our ancien regime of schooling, which eliminates the parent from any role in the process; as such minds see it, the State rescues half of America’s children from their parents’ mistakes by conscripting them each morning to government custody. I will call these pundits “shepherds”; they applaud as the lambs of the hoi polloi get herded into that safer fold of the State.

It takes guts not common to the Shepherd to argue plainly that the well-off parent is up to the job, but not the rest of you. Better just to stand by as the State properly does for worker and the poor what better-fed families do for their own children - i.e., choose.

Oddly enough these same Good Shepherds - so often wordy - seldom comment on the wisdom and justice of family choice when exercised by those other parents who can afford it. Of course, such comfortable folk can actually assert a constitutional authority over the child; and it would be a steep climb - legally and politically - to disentitle every parent, as Oregon attempted nearly a century ago. Still, one might expect our contemporary civic sentinels to notice and regret the damage to children and society wrought daily by these imperfect parents making choices. The honest dogmatists of Oregon were candid and public about their fear of feckless parents both rich and poor; today’s enemies of choice remain oddly reserved and ambiguous regarding the sovereignty of our more prosperous mamas and papas.

Such restraint suggests profound ambivalence. Often we watch the very prototype of the Shepherd - the public school teacher and union leader - execute their own child’s exodus to a more favored district residence or even to a private school. Such thoroughbred parents on occasion even manage a different postal address for the child, one where in fact he is seldom to be found. (Less popular school districts now pay bounties to detectives to assure that resident parents do not divert illegally the per-pupil state subsidy for their child. Parents caught cheating get prosecuted.)

Is this silence of the the Shepherds a shroud for their own embrace of choice by the well-off? As these gurus run with the hare and hunt with hounds, they remind us of that familiar foreign critic of America’s sins - the one who turns handsprings to secure his own visa.

Is the Shepherd simply a hypocrite? Often yes; but often no. In this short piece it would be hazardous to critique the possible excuses of the Shepherd - coherent and otherwise - for his apparent approval of society’s systematic bullying of the poor parent while indulging the tastes of the rich. In my experience - apart from union intimidation - the most common explanation is the simple blindness of the middle class and the academy to the reality of the coercion. (more…)

At Jeb Bush’s National Summit on Education Reform in Washington, D.C. last week, two prominent education reformers from the center-left and the center-right joined to make a remarkable statement about parental choice. Asked from the audience to name their “No. 1 idea” to improve public education, former New York City school chancellor Joel Klein and former U.S. Secretary of State Condoleezza Rice answered with a remarkably united voice.

At Jeb Bush’s National Summit on Education Reform in Washington, D.C. last week, two prominent education reformers from the center-left and the center-right joined to make a remarkable statement about parental choice. Asked from the audience to name their “No. 1 idea” to improve public education, former New York City school chancellor Joel Klein and former U.S. Secretary of State Condoleezza Rice answered with a remarkably united voice.

Their three minutes of extemporaneous remarks are well worth your time, and are available through C-SPAN.org here.

In brief, Klein spoke of the way various types of learning options, including charter schools, have helped spur improvements in New Orleans and Harlem: “About a third of the kids in Harlem in the third grade are in charter schools. What’s amazing is the Harlem District went up, and this is apples to apples, went up dramatically from when we started this intensive choice process there to now. … Not only did the charter schools outperform almost everybody, but the public schools … actually moved up significantly themselves.”

Rice spoke to how competitive pressures have produced a “catalytic” effect in higher education, and noted that only wealthier families tend to have choice in a K-12 system where pupil assignment is determined only by geography: “So the only people stuck in neighborhood schools are poor people, and that’s the height of inequality. And that’s why I’ve called it a civil rights issue.”

The gurus of school choice have often shuddered at the word “regulation.” On occasion this instinctive hostility has been tactically justified. Viewed objectively, however, it is meaningless - even self-contradictory. And too often has it driven fair-minded listeners from the civic conversation about the ideal structure of this very necessary reform called “school choice.”

Regulation is itself a pre-condition of any system of choice, whether the intended beneficiary be the have-not family or the comfortable suburbanite. The empowerment of parents always comes as the effect of a particular set of rules. Nor is this reality limited to reforms aimed at the complex and private world of the family. The simplest of legal systems - one, for example, that embraced the most complete market freedom - would depend upon the regulatory oversight of some third-party authority to interpret and enforce those promises which constitute any market. Contracts are not self-enforcing. Nor is parental choice or any other human regime.

Children present perhaps the most obvious example of my point; by nature their lives will be regulated by someone. The only question is “by whom?” That the state will be one of the players seems quietly accepted by all. This includes the school choice reformer who has unequivocally embraced compulsory education - a thing to be enforced and paid for by the state. The issue, then, becomes how far beyond the requirement of schooling shall the state penetrate the natural territory of the family?

We appear to agree on rules forbidding child abuse. Beyond this and compulsory schooling, where shall we the people allow (or require) the state to go? The answer can come only in some cluster of regulation - some that command, some that limit the state. If it is parents who are to rule (i.e., to regulate their children), then government must be commanded (again, regulated) first - in a positive way - to subsidize the family’s preference in schooling, and second – negatively - to avoid subverting parental authority by unnecessary busybody rules. The state itself must be ruled in both positive and negative ways: it must do this; it may do this - but not that. (more…)

An attempt to bring a tax credit scholarship to low-income children in North Carolina succumbed to a short session and broader tax and education politics as the General Assembly adjourned on Tuesday. But the effort is worth noting in part because of the group pushing it.

An attempt to bring a tax credit scholarship to low-income children in North Carolina succumbed to a short session and broader tax and education politics as the General Assembly adjourned on Tuesday. But the effort is worth noting in part because of the group pushing it.

Parents for Educational Freedom in North Carolina is a diverse, progressive organization with a membership of 60,000 and is led by a home-grown talent, Darrell Allison, who has a legal and civic mind and has worked in the White House and the U.S. Department of Justice. Allison and his team bring both a zeal to help struggling low-income children and a concern for getting the policy right and making the program accountable. (Disclosure to readers: I worked with PEFNC in preparations for the bill.)

The bill that ultimately was filed, HB 1104, fell short of the type of academic testing requirements the group was seeking. But overall the language kept faith with the 1,200 people who rallied at the Capitol in May, the 4,000 calls and emails that urged lawmakers to act, and the Democrats who signed on as co-sponsors. Importantly, at a time when some tax credit scholarship programs are coming under scrutiny for laws that lack genuine accountability and transparency, Allison and his team were trying to make sure their program had plenty of both.

The “Equal Opportunity Scholarship” was to be funded by contributions from companies that in turn received a dollar-for-dollar tax credit, and the scholarships were to be restricted to students with genuine economic disadvantage – those with household incomes not exceeding 225 percent of poverty. Scholarship organizations could not be tied to any school and could not allow donors to designate that their money go toward any particular student or school. The scholarship itself was to be $4,000, or just under half the amount the state and local governments spend on each public school student. Early fiscal evaluations showed that some versions of the bill saved money even when factoring only the state portion. (more…)