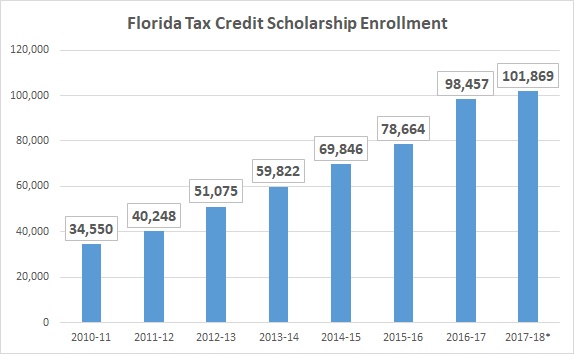

The nation’s largest private school choice program has passed another notable milestone. During the coming school year, more than 100,000 low-income and working-class students will enroll in private schools using Florida tax credit scholarships to help pay tuition and fees.

Step Up For Students is a nonprofit organization that helps administer the program. (It also publishes this blog and pays my salary.)

The organization stopped enrolling students on Friday afternoon. Right now, about 101,869 students are enrolled for the coming school year.

That figure comes amid the highest-ever demand for scholarships. More than 177,000 students started the process of applying for scholarships. Step Up has approved more than 23,000 applications for students it does not have the money to serve.

Doug Tuthill, the president of Step Up, said rising demand is part of a larger “culture shift” in public education.

Educational choice in all its forms is becoming the norm. School districts are expanding magnet programs. Charter school enrollment continues to grow, despite fewer new schools being allowed to open. Home education is also on the rise.

“Hopefully the program will eventually be able to serve every student who applies and qualifies,” Tuthill said. “Right now, we’re not even close to meeting the demand. I feel bad for the thousands of families who are being turned away every year.”

Even with the enrollment milestone, several constraints limited growth for the coming year.

This year, new legislation raised the maximum value of each scholarship. Funding levels can now reach $6,420 for elementary school students, $6,712 for middle school students and $7,004 for high school students. That’s up from last year’s maximum of $5,886 for all students.

In addition, Florida law caps the amount of tax-credited contributions non-profit scholarship organizations can receive annually from companies. This year, the cap is about $698 million, up from $559 million the previous year. Step Up administrators say they probably will not raise the full amount this year.

So far, they’ve raised just over $555 million. A second organization, AAA Scholarship Foundation, has reported about $8.6 million in tax-credited contributions, but has not yet announced how many students it plans to serve.

Despite these limitations, Florida’s tax credit scholarship is far and away the country’s largest private school choice program. As of 2015-16, it accounted for more than one out of every two tax credit scholarship dollars raised nationally, according to the American Federation for Children.